The Trampoline Society: What Hong Kong Can Learn From Singapore’s Social Mobility Model

Schwarzman Scholars worked together to create an academic journal, reflecting their ability to think critically about the Middle Kingdom and the implications of its rise. These collections of thoughts come together to form “Xinmin Pinglun,” our Journal dedicated to the publication of the informative and analytical essays of our scholars. As the application deadline for the class of 2019 is approaching and the arrival of the incoming class is on its way, we are sharing pieces from Ximin Pinglun to give insight into the critical thinking and scholarship taking place at Schwarzman College. Here, Alexander Chan, (Class of 2017) shares his thoughts on the steps Hong Kong can take to address social mobility.

A parent once told me, “We want our kids to lead better lives than ourselves. Is that too much to ask?” Of all things that society aspires to, none is more personal than the hopes that every parent has for their child to have better lives than their own, yet also reliant on decisions beyond their control.

Globally, social mobility is increasingly becoming a myth with a rise in static inequality. Political scientist Robert Putnam highlights how working class children are disadvantaged even before school begins, given huge gaps in their education exposure at home. In both the United States and United Kingdom, “social mobility” was a key theme across the major parties in the most recent elections in 2015-2016. This growing opportunity gap hinders economic productivity, widens and fragments class divides, and affects the integrity of our democracies.

I am thankful to have had the chance to work on youth and community projects focused on social mobility in both Singapore and Hong Kong. As a result, I developed a sense of the subtle differences that play out in the lives of the students and families in Hong Kong as compared to Singapore. It prompted me to go back to the data to discern the wider systemic decisions at work. What we see is that Singapore has indeed fared better in enabling social mobility than Hong Kong by utilizing a “trampoline model for mobility,” designed to include a safety net to ensure against catastrophes as well as “trampoline springs” to create opportunities for growth. Hong Kong will do well to learn from Singapore in designing a more comprehensive basket of policies to address social mobility.

The elusiveness of mobility in Hong Kong

Broadly speaking, we can assess mobility on two levels. First is the general economic growth of an economy that in turns affects the overall resources and opportunities available for distribution. The second level is the social mobility of a place, the best indicator of which is how likely are individuals or households in the lowest income tier able to reach the higher-income levels and narrow the gap between the poor and the rich over time.

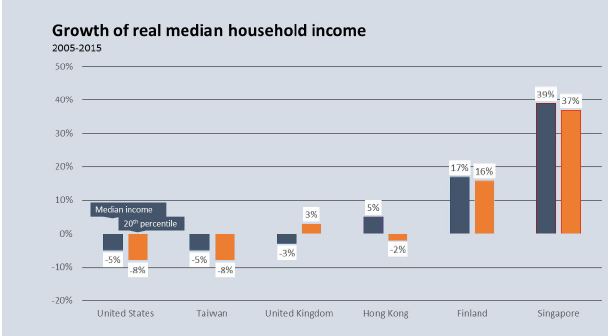

Both Singapore and Hong Kong underwent rapid economic growth in the 1970s-80s but subsequently has slowed with maturation. The decline in growth has been much more significant in Hong Kong than in Singapore. Singapore’s GDP per capita is today $10,000 more than that of Hong Kong’s. While economic growth only shows part of the story, assessing how much real median household income has grown serves as a valuable proxy for the level of social mobility. Growth among lower income percentile households best captures whether economic opportunities and growth are broadly distributed. Singapore has outperformed Hong Kong on both indicators. In terms of cumulative household income, Singapore outgrew Hong Kong by some 35% over the past ten years; at the 20th percentile, Hong Kong experienced declines in income whereas Singapore experienced 37% growth. Such figures highlight the results of different policies and forces at work.

There is much to be said about the forces of globalization and technological change with respect to inequality. No doubt these too have had its impact on Singapore and Hong Kong. However, if we just look at these two similar Asian cities, it is evident that Singapore must have been doing something differently that has enabled it to have much better economic growth and social mobility as compared to Hong Kong.

It’s a trampoline, not a safety net

In the annual St. Gallen Symposium in 2015, the defining news was how Singapore Deputy Prime Minister Tharman Shanmugaratnam spoke back against a BBC journalist’s assertion that the country lacked a social safety net. Shanmugaratnam responded that Singapore has something better – a trampoline society. The key goal of a social safety net is to function as a societal insurance against the potential calamities of life. Generally, a well-functioning net can be conceptualized in two aspects – net design which is the actual breadth and depth of the net that covers citizens and net support which is the fiscal strength of the government to support that net.

For the longest time, the concept of a social safety net was almost politically taboo to bring up in Hong Kong’s laissez-faire economy. This taboo has improved in recent years as welfare policies have increased, but are still mostly conceived as temporary measures, including policies such as one-month rental relief or subsidy for public housing tenants and basic child and elderly allowances. Despite the good these policies bring about, they all stop-short of a robust safety net and proper poverty policy.

In Singapore’s context, almost all of its welfare policies is conceptualized in terms of building cumulative assets for the long term. There is deliberate effort to make the policies universal (available to everyone) and holistic (across all age range). Such asset building improves household stability by cushioning income shocks while also creating an orientation the future given that contributions are accumulated for growth. One example is that of Child Development Savings Scheme, where beginning from birth the government matches contributions made by parents into a child savings account. When schooling begins, this is then extended to an Edusave account that students can use for a range of school activities like sports and study trips. This then transfers to a Post Secondary Education Account that extends these subsidies into tertiary education. Throughout the education year, the government, schools and parents top up this account (with caps on government subsidies depending on income), and this money helps students accumulate dedicated funding for their education. Inclusive asset-building policy helps create opportunities for saving and asset accumulation that are universal, progressive and life-long.

A robust safety net requires strong net support – that of fiscal capacity of the government. Strong fiscal capacity and stability requires a sustainable and diverse stream of government revenues. Currently, Hong Kong employs a low tax economy while relying heavily on land sales and housing sales tax as key sources of revenues. Inevitably, this reliance on real estate has also driven up housing prices massively. The government is thus stuck in a conundrum as on one hand it deems low tax as a key comparative advantage of Hong Kong’ status as a global capital and financial center, while on the other hand it results in a heavy reliance on real estate as the only credible source of revenue.

Singapore has less reliance on land sales and adopts slightly higher corporate and income tax rates than Hong Kong. The key distinguishing government revenue stream in Singapore is actually the presence of a Government Service Tax (GST) charged on all goods and services (approximately 7% charged on all transactions). This tax in and of itself contributed to roughly 15% of all government revenues in fiscal years 2014-15. In addition, Singapore also has high taxes on vehicle usage (primarily to prevent crowding and congestion) that thus adds additional revenue for the government. In all, these other taxes help create alternative streams of revenue for the Singapore government and prevent over-reliance on singular sources that will likely be unsustainable over the long run. One other distinct difference between Singapore and Hong Kong is that in Singapore the tax burden is on items that are discretionary, unlike Hong Kong where the huge revenue burden on housing falls disproportionately on the poor who end up being priced out of the market.

Creating opportunities for economic growth

While a safety net helps to break the fall and ensure against the misfortunes of life, it is the springs of the trampoline that lift people back up. An ideal trampoline system will actively enact policies and supporting ecosystems that create opportunities for inclusive and diversified economic growth. Ideally, this will consist of core engines- basic building blocks in the system that create opportunities, along with growth engines- additional levers to inspire more diverse growth in the future. When it comes to core engines to enable opportunities for growth, perhaps none is as important as an education system that adopts a capabilities approach to mobility. This type of system is in the vein of the work of Amartya Sen and Martha Nussbaum, who focus on the creation of opportunities to enable individuals to achieve the kind of lives they have reason to value. This requires diversified pathways and career options.

“Singapore has made it a point to establish diversified pathways and opportunities for education.”

In Hong Kong, the fact that the end-goal of the education system has become focused on entering universities rather than career pathways is a key reason why mobility has become so limited. (In 1994, the government converted vocational schools to universities.) Singapore has made it a point to establish diversified pathways and opportunities for education. In 1979, Singapore established a new system that moved away from “one-size-fits-all” and instead emphasized a shift towards a multi-path meritocratic system. In the Singapore system there are three main categories of high schools created: academic high schools to prepare for university; polytechnic high schools that focused on advanced-level occupational training; and technical institutes that focused on practical skills for the lowest achieving one-fifth of students. Such a system ensures a balance between academic training and practical skills-based training.

In the 2000s, the government went further to create even more options by opening high schools dedicated towards pursuing sports and the arts as a career. The system was also complemented by emphasizing continued learning and education. For example, the “Skills Future Credit” grants subsidies for citizens to undertake courses offered by the Institutes of Higher Learning or the Singapore Workforce Development Agency. The “Earn and Learn Programme,” enables recent graduates from polytechnics and vocational institutes to be matched with employers for structured on-the-job training and mentorship while they study for an industry qualification. These employers receive grants (up to SGD$15,000) for every graduate that they hire.

Education pathways then need to be channeled into economic opportunities. Classical development economists often explain that in order to escape the middle-income trap, a country’s economy must successfully transition from primary sectors (agriculture) to secondary sectors (manufacturing) and eventually to tertiary sectors (services). However, despite this outlined path, there are very few theories on how a developed country or city can continue to successfully grow or sustain its economy. Hong Kong’s economic growth during the 1980s and 1990s was based on its manufacturing and financial sectors which brought about a rise in productivity and incomes and created sufficient fiscal strength that allowed for investments in welfare services. Yet, as evidenced by the slowing GDP growth in the past 10-15 years, Hong Kong’s economic structure has started to change. Moreover, while Hong Kong successfully transitioned from a manufacturing hub to a financial and services hub, the city has since been in a state of economic inertia. Compared to other Asian Tigers, Hong Kong has perhaps been the slowest to adapt to global economic shifts and to diversify its economy. Hong Kong’s very success as a services hub with nearly 60% of GDP contribution (with huge concentration on finance) has also meant that there has been a lack of diversification of primary economic engines.

Correspondingly, even though Singapore had a similar model of growth to Hong Kong in the 1970s-90s, beginning from 2000s Singapore took deliberate efforts to diversify its economy. Continuing its traditional strength in the manufacturing sector, it has transitioned to higher value-added manufacturing industries such as biotechnology and electronics (services only take up ~30% of GDP contribution). In particular, Singapore has doubled down its efforts to develop into a life science and biotech hub. This has attracted eight of the top ten pharmaceutical and medical technology companies to set up their headquarters in Singapore. Economic diversification has been further complemented by the development of professional talent, including more than 1,000 PhDs and some 5,000 engineers to serve in the industry.

“The amount of high-tech venture capital investment in Hong Kong was almost ten times smaller than Singapore in 2014.”

The final part of the trampoline-based model is the capacity to promote innovation and entrepreneurship, in order to catalyze new economic growth engines. Based on the 2015 Global Innovation Index, Hong Kong’s ranking has declined steadily from eighth in 2012 to fourteenth in 2016, while Singapore has grown strongly to fifth globally, with Hong Kong lagging behind Singapore in 5 out of 7 areas.

Hong Kong has often taken a minimal government intervention approach to innovation and it was only recently that the new Innovation and Technology Bureau was established after years of delay. Innovation is a public good and requires the government to both regulate intellectual property issues and encourage entrepreneurial ecosystems. Hong Kong has traditionally lacked institutions which promote innovation, and thus has experienced slow innovation growth. In addition, despite being a sophisticated financial hub, the amount of high-tech venture capital investment in Hong Kong (roughly US$40 million) was almost ten times smaller than Singapore (some US$325 million) in 2014. Finally, there is also systemic under-investment in R&D and talent development. Hong Kong’s expenditure on R&D as percentage of GDP was only 0.74% in 2014 compared to 2.2% in Singapore. Likewise, average education spending per person was roughly US$10 thousand in Hong Kong compared to some US$17 thousand in Singapore. All this points to the consequences of the government’s non-interventionism approach that has severely affected growth of innovation.

Singapore’s system is built on an active innovation framework created by the government. For one, there is a diverse set of government agencies and institutions dedicated to different aspects of the innovation ecosystem, including the Agency for Science, Technology and Research; IESingapore, which focuses on fostering investments in local enterprises; and the Economic Development Board, which focuses on attracting foreign investment. The Singaporean government also supports innovation by matching private venture capital investments. This is different from Hong Kong, where private and public funding are completely separate. In addition, there is a large focus on R&D investment, including creation of various research clusters. Finally, in Singapore there is constant investment in talent development such as the A*STAR graduate scheme that gives comprehensive scholarships to Singaporean PhD students to study overseas in top universities in Europe and the US with aims of returning to serve in Singapore’s research field in future. It is this active intervention by building supporting institutions, matching funding and R&D, and talent investments that gives Singapore an edge in its innovation and entrepreneurship systems.

A model for Hong Kong

There are numerous lessons to be gleaned from Singapore’s trampoline model, but if one were to extrapolate three specific policy lessons for Hong Kong they will be as follows:

- Better build long term welfare assets by reforming MPF. Singapore focuses on building of long-term assets when establishing a social safety net structure, especially in terms of individual cumulative welfare saving accounts launched by the Singapore government. In Hong Kong, after years of advocacy from labor groups, the government launched a pension fund system called the Mandatory Provident Fund (MPF) Scheme in 2000. This is a scheme of compulsory saving, where employers and employees contribute money (five percent of salary from both parties) to invest in privately run funds, and upon retirement, employees receive a lump sum payout. The problem with this scheme is that it is driven entirely by market providers with almost minimal government involvement, placing all risks on contributors. There is thus opportunity to reform the MPF, possibly to include some sort of government contribution, allowing for early withdrawals for healthcare or housing, and better protections against losses.

- Implement GST to diversify government revenue stream. The most viable way to diversify Hong Kong’s government revenue is to introduce some form of Government Service Tax to help to broaden the tax base while maintaining the low corporate and income tax status of Hong Kong. In 2006, the Hong Kong government pushed for a GST, but it was eventually rejected by the legislature. Given the adverse impact on the budget caused by its dependence on land sales and the fiscal pressures from an aging population, there’s an unprecedented need to create new streams of government revenue. A GST at five percent, with exceptions on exports and real estate, would thus be helpful both in terms of revenue stability as well as in clarity of tax scope set.

- Focus ITB on ecosystem building not picking winners. The newly introduced Innovation and Technology Venture fund and the new Innovation and Technology Bureau (ITB) will add a cumulative HK$4 billion investment by the government into Hong Kong technology startups. However, the Hong Kong government has little or no history identifying successful

startups in which to invest. Moreover, the government should give priority to building an entrepreneurial ecosystem that best supports innovation, rather than making direct investments in specific startups. The Hong Kong Innovation and Technology Bureau should thus take a page from the Singapore handbook and use the government’s investment to build networks and hubs to facilitate knowledge exchange. Furthermore they should invest more in R&D support (such as applied research grants) and the continued development of research and entrepreneurship talent (such as education scholarships and research development programs). At the end of the day, the key feature of the trampoline model is not so much the building blocks that form its mobility policy but rather the wider culture and mindset that the trampoline embodies. It is this combination between insurance and opportunity that truly elevates Singapore as a model for social mobility.

If Hong Kong can perhaps just take a lesson or two from the trampoline playbook, it will go a long way to addressing emerging socioeconomic ills. Singapore has its own downsides as well, but all things considered, the trampoline model has better enabled social mobility. Furthermore, addressing some of these ills may in fact help alleviate some of the political tensions that Hong Kong faces. Hong Kong should adopt aspects of Singapore’s trampoline society model, not only because these policies have the potential to stimulate economic growth, but also because it will allow its citizenry to achieve the lives they desire and arguably this is one of the more important roles of government.

Alexander Chan (Class of 2017) is from Hong Kong, and graduated from the University of Hong Kong and Oxford.